A Rewarding Journey in Financial Planning

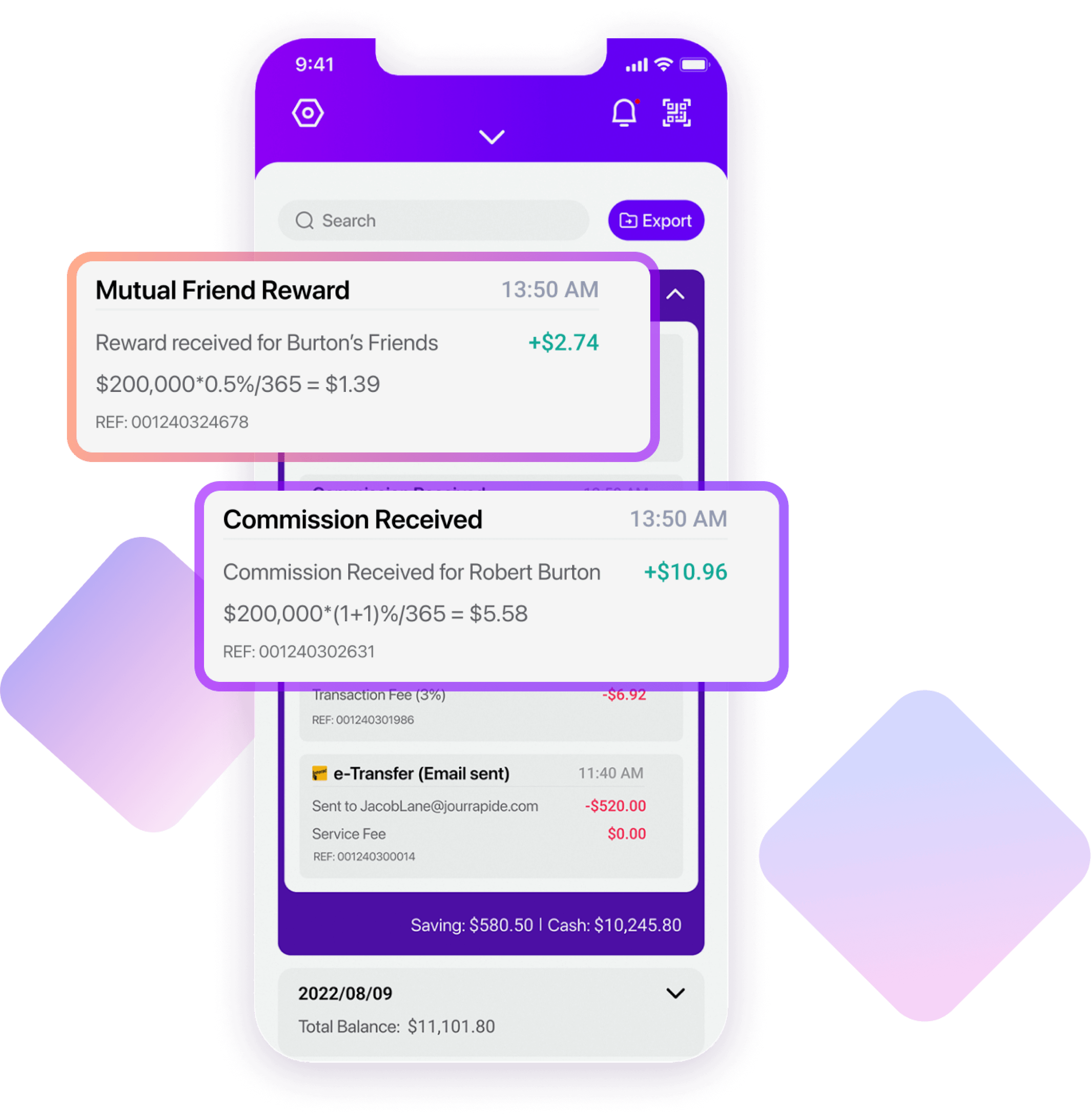

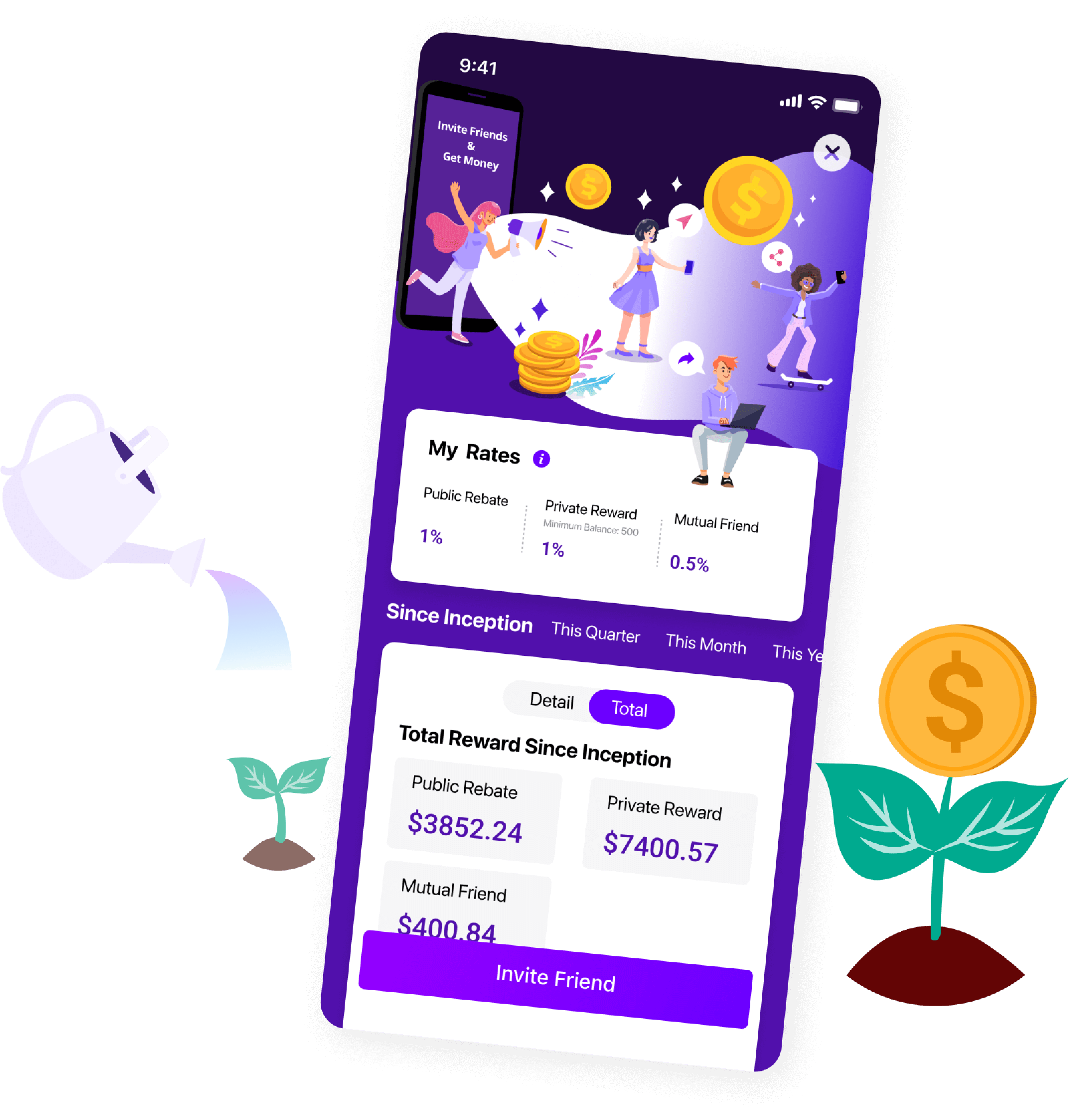

Get annualized commission rates from 4% - 6% on every client you bring in. You can decide on the rebates you offer to your clients and how much you keep for yourself. Get all payments settled daily.

Our industry-leading rates and professionally made payment processing solution finds use cases across industries. And it is one of the fastest ways to transfer money and fund account digitally.

Learn how it worksMade Not Just for Businesses

As a Chartered Financial Planner (CFP), you know that cheque processing and fund refunds can take up unnecessary time. Why not tap into TapIn Pay to make payments simple, and seamless?

With TapIn Pay, you get flexible payment options and an all-in-one payment platform that offers easy access to different payment options, from WeChat Pay to Google Pay. You take your pick. At your convenience.

Know your options here

Transfer Up to $25K per Transaction!

Transfer Up to $25K per Transaction!

Easily transfer up to $25K CAD per transaction

Transfer money to other MasterCard cards in a few clicks

Without any holding period

No questions asked! Make transfers on the go, in real-time

The Flexible Payment Options You Needed

As a Chartered Financial Planner (CFP), you know that cheque processing and fund refunds can take up unnecessary time. Why not tap into TapIn Pay to make payments simple, and seamless?

With TapIn Pay, you get flexible payment options and an all-in-one payment platform that offers easy access to different payment options, from WeChat Pay to Google Pay. You take your pick. At your convenience.

Sign up your own account first

What’s in it For You as a Chartered Financial Planner?

Do you think your clients aren’t committed enough? Worried about early redemptions and surrender risks?

TapIn Pay offers you the ability to generate daily returns, at competitive commission rates! No delays. No early cancellation risks. And all with the added benefit of daily returns - paid straight to your account.

Frequently Asked Questions

Learn the basic answers here. Feel free to chat with us now.

How does TapIn Pay benefit Certified Financial Planners?

For every client payment, CFPs earn a certain commission - which is paid to your TapIn Pay Savings account by 4 a.m. PST of the next day**! These incentives are flexible and bespoke to each client, so the commission matches the amount used or transferred.

How does TapIn Pay benefit CFP clients?

CFP clients get access to several benefits of using this product, including instant fund release, lower rates, expert gateway integration, white label service, and more. In addition, TapIn Pay also offers clients an aggregate account with daily returns.

What client issues can TapIn Pay solve?

When funds are released, they get transferred and are immediately available for use. By integrating this payment gateway into their system, clients can focus on their core business without worrying about the lack of payment management options.

Can you use TapIn Pay as a Financial Tool and instrument?

Yes, you can. Businesses will love the flexibility TapIn Pay offers - and how they can use it. Use it as a tool by implementing it in their business - whether using it in-house or as a payment option. Use it as an instrument to keep money, with daily returns, in real-time.

How is TapIn Pay’s daily return program different to a GIC?

A GIC is issued by a bank and is a fixed rate that is often non-redeemable for a certain period, while TapIn Pay’s daily return depends on several other factors including the number of people you’ve referred and the aggregate amount, and is redeemable daily.

How much are the transaction fees?

The amount you pay depends on the payment method you choose. Interac payments cost as little as $0.85 per transaction. WeChat and AliPay cost 1.5% of the transaction amount. And if you’re using credit cards, Apple Pay, Google Pay, or other POS, you may have fees as high as 3%.

Where are the funds kept?

All funds are kept with our trusted banking partners TD and RBC and regulated by FINTRAC. TapIn Pay does not have access to your funds for uses not defined in the trust agreement.

Do I have to spend anything to get started?

No, we build the payment gateway, and we take care of the operations. All you need to do to onboard is to sign up an agreement with us.

Book an Appointment

Want to partner with us? Book a Zoom call. Or, come by our office in Richmond, BC.

#110-6011 No.3 Rd Richmond, BC Canada

business@tapinpay.ca

778-601-3838

Your information

Friday, July 29, 2022 2:15

Edit

First Name *

Last Name *

Your Phone Number *

Your Email Address *

Back

Individual and Platforms use the TapIn Pay to collect online payments through Credit Card and gateways like PayPal and Wechat Pay, send email transfers and spend money with a TapIn Mastercard.

© TapInPay