We have in-built connections to payment gateways. To get started, you just need to connect to us.

Whether your start-up is at MVP or is now a fully-fledged business, offering multiple payment options always helps your revenue. Integrating a proper payment solution can seem tedious - and distract you from your core business.

With TapIn Pay, you can implement major payment gateways for your business in as little as a week!

Solve your payment integration headaches.

You focus on the big picture

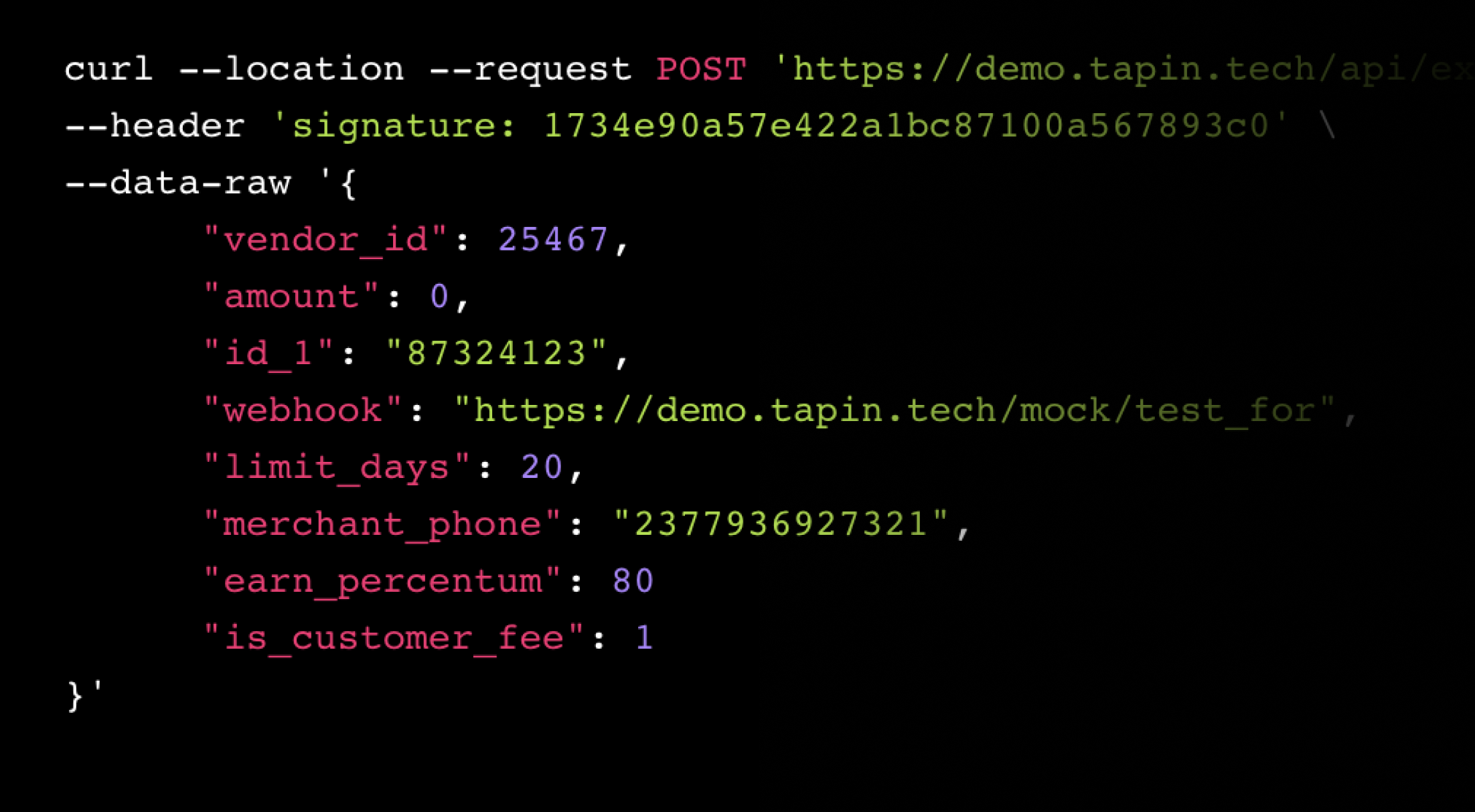

Easy Access to Funds

Create payment requests and easily direct money straight to the merchants' TapIn Pay account.

Merchants can then e-transfer the funds. Or, use the TapIn Pay MasterCard and spend the funds instantly.

Hassle-Free Sign-up

Save time on merchant payment transfers. Just ask for their TapIn Pay account phone number to pay.

Worried about merchants not having a TapIn Pay account? The TapIn Pay app is just one download away and takes seconds to sign up!

You can also send a download link through text.

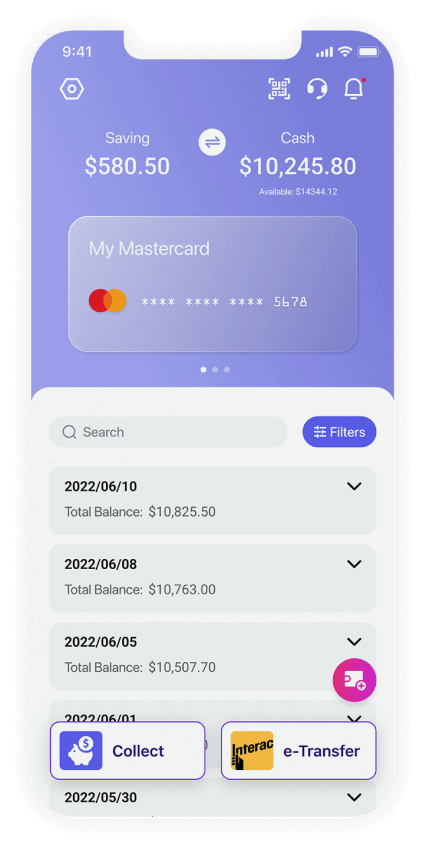

Dynamic Commission Rate

As a business, we understand you may charge a commission to your merchants. With TapIn Pay, you can easily set the rate as you need, per merchant, or per transaction.

Our API allows you to specify a different commission rate for payments with maximum flexibility.

Instant Release

Merchants often complain about how long it takes for them to receive their funds.

Gain the competitive edge you need by partnering with us and reduce the payment hold delay to zero.

When you pay merchants, they get paid instantly. And they have access to their funds right away!

Have your own white-labeled payment app and cards

Owning your own payment app is a powerful statement. White-label TapIn Pay for your business. So your merchants know you've your own payments app.

A white-labelled app is listed on app store with your icon, your brand and your color scheme. That's not all. Your merchants will be swiping MasterCards with your logo on it.

Powerful Brand Statment

Launch In One Week

White-labelled Payment App

Branded MasterCard

Choose The Right Plan for Your Business

Stop wasting thousands of dollars on hundreds of development hours. Instead, focus on your business.

Our payment specialists, designers and developers are here to help.

Bill Monthly

Bill Annualy

Save 20%

Start

$

Per Month

Get Started

Grow

$

Per Month

Get Started

Scale

$

Per Month

Get Started

Frequently Asked Questions

Have questions? Here are some we get asked all the time. Have something else in mind? Feel free to chat with us now.

Is my fund safe?

Yes, your funds are safe. We are regulated by FINTRAC. Your fund is kept with most stringent compliance requirements.

Where is my fund kept?

Your fund is safely kept with our banking partners TD and RBC in a trust account. There's no way we can access it for uses not defined in the trust agreement.

How much is your transaction fee?

Transaction fee percentage varies per gateway. Interac is a fixed $0.85 per transaction. WeChat and Alipay is 1.5%. Credit Card, Apple Pay, Google Pay and POS are 3%.

Who pays for transaction fee?

It's up to you. Your API call can speicify to add the transaction fee to the platform, payer or merchant at payment level.

Can I get a free demo for my platform?

You can get a free account as individual user to learn our basic features.

Where does my commission go?

If you charge a commission on your merchant, it's split to your default TapIn Pay account. You can also access the funds via e-Transfer and MasterCard.

Do I own the white-labelled app?

No, you don't. It's an app we built for you under the terms of subscription.

Do you offer lending, crypto, USD accoutns or foreign exchange services?

No, we don't offer these services currently.

Can my merchants use their accounts to receive money for other purposes?

Yes, they can. But you would not see those transactions.

How do I cancel my subscription?

You can do that by logging into your platform dashboard.

What happens to my merchants after I cancel my subscriptions?

They will be converted to individual accounts and require to pay $10 monthly account fee should they continue to use our full features.

What is e-Transfer limit?

It's $25,000 CAD per transaction.

What happens if I exceed my maximum accounts?

Your payment request to new destinations will fail. You can change your subscription in dashboard.

Ready to get TapIn Pay for your platform?

Don’t take our words for it. Experience it yourself.

Individual and Platforms use the TapIn Pay to collect online payments through Credit Card and gateways like PayPal and Wechat Pay, send email transfers and spend money with a TapIn Mastercard.

© TapInPay